Industries Overview

Our research focuses on the five core coverage areas below. We apply our rigorous research methodology to our reports, charts, forecasts, and more to keep our clients at the forefront of key developments and trends before they hit the mainstream.

Latest Articles

Browse All →Holiday spending will exceed pre-pandemic levels for first time

Article |

Dec 4, 2023

Social media put a scare into another bank’s investors after a risky investment soured

Article |

Dec 4, 2023

Prime Video misses the mark on Black Friday football, but it’s not a loss

Article |

Dec 4, 2023

Grocery, in-store pickup drive click-and-collect growth

Article |

Dec 4, 2023

5 charts to prepare marketers for 2024

Article |

Dec 4, 2023

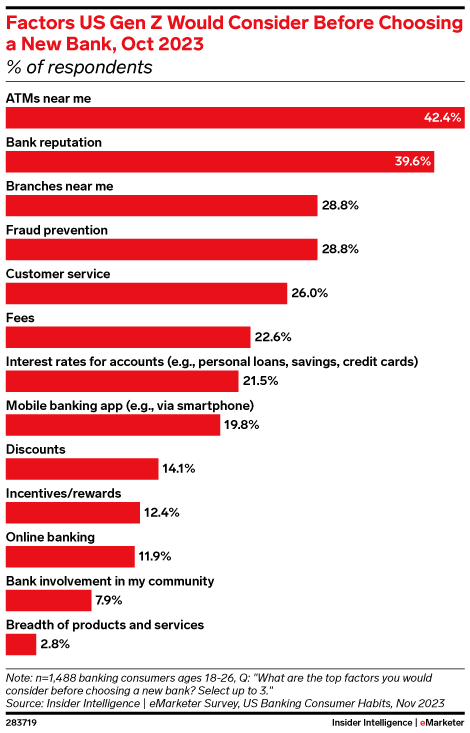

For banks, mobile and social are the keys to building awareness among younger consumers

Article |

Dec 4, 2023

Retail media is the fastest growing ad channel, but ‘is not invincible,’ our analyst warns

Article |

Dec 4, 2023

3 recent retail media developments and why they matter

Article |

Dec 4, 2023

In 2024, retail media and streaming TV will build on each other’s momentum | Sponsored Content

This article was contributed by Roku.

Article |

Dec 4, 2023

4 tips on using Performance Max for ecommerce success in 2024

Article |

Dec 4, 2023

Products

Insider Intelligence delivers leading-edge research to clients in a variety of forms, including full-length reports and data visualizations to equip you with actionable takeaways for better business decisions.

Forecasts

Interactive projections with 10k+ metrics on market trends, & consumer behavior.

Learn More →Charts

Proprietary data and over 3,000 third-party sources about the most important topics.

Learn More →Industry KPIs

Industry benchmarks for the most important KPIs in digital marketing, advertising, retail and ecommerce.

Learn More →About Insider Intelligence

Our goal at Insider Intelligence is to unlock digital opportunities for our clients with the world’s most trusted forecasts, analysis, and benchmarks. Spanning five core coverage areas and dozens of industries, our research on digital transformation is exhaustive.

Methodology

Rigorous proprietary data vetting strips biases and produces superior insights.

Learn More →Events

Browse our upcoming and past events, recent podcasts, and other featured resources.

Learn More →Customers don’t understand what factors into banks’ lending decisions—and they want more control

Insider Intelligence

Media Services

Free Content

Contact Us →

Worldwide HQ

One Liberty Plaza9th FloorNew York, NY 100061-800-405-0844

Sales Inquiries

1-800-405-0844ii-sales@insiderintelligence.com

* Copyright © 2023

Insider Intelligence Inc. All Rights Reserved.